As 2025 comes to a close, one thing has become clear across financial markets: real-world assets (RWAs) are no longer a niche experiment. They are becoming a foundational component of the digital economy — and energy assets, specifically U.S. oil & gas royalties, are emerging as one of the most compelling sectors within this new landscape.

For decades, mineral and royalty interests were accessible only to insiders with specialized knowledge, patience for administrative complexity, and substantial capital. Today, that gate is opening. Tokenization is transforming historically fragmented, paper-based assets into programmable, auditable financial instruments that can be accessed globally.

As we look toward 2026, here’s why we believe tokenized energy royalties are set to reshape investor portfolios worldwide — and how Mineral Vault is leading that shift.

1. Yield Is King — and Energy Royalties Deliver It Reliably

For years, global investors chased yield in low-rate environments. Now, with interest rates expected to ease and traditional income assets repricing, attention is shifting back to stable, real-asset-backed yield.

Mineral and royalty interests are uniquely positioned:

They generate monthly cash flow.

They are inflation-protected because hydrocarbons sell at spot commodity prices.

They carry no operating costs for the royalty owner.

They often produce income for multiple decades.

In an era defined by macro uncertainty, tokenized royalties offer something rare: predictable yield from a physical economic activity — American energy production.

2. Tokenization Is Moving From Idea to Infrastructure

2025 marked the transition from experimentation to execution. Tokenization platforms, custodians, and L1/L2 ecosystems matured dramatically. Plume Network, which Mineral Vault leverages for token issuance and yield distribution, represents this shift — infrastructure purpose-built for RWAs rather than retrofitted for them.

As RWA-native chains scale, we expect 2026 to bring:

Instant secondary liquidity for historically illiquid assets

Smarter compliance primitives that preserve global accessibility

Unified yield markets where tokenized energy, real estate, and credit coexist

Institutional on-ramps that normalize digital ownership of private assets

Energy royalties, with their steady cash flow and clean legal structure, fit this world perfectly.

3. Global Investors Want Access to U.S. Energy — But Haven’t Had It

The United States is the world’s largest producer of both oil and natural gas. Yet for international investors, gaining exposure to U.S. mineral interests has historically been nearly impossible due to:

Title verification challenges

Administrative complexity

High minimum investments

Jurisdictional barriers

Illiquidity

Tokenization removes these barriers in a single stroke. Today, an investor in Singapore, Brazil, or Europe can access U.S. energy royalty cash flow through a compliant, digital instrument that automates:

Ownership

Cash distribution

Documentation

Record-keeping

This is unprecedented — and demand is rising fast.

4. Portfolio Construction Is Being Redefined

Investors increasingly want assets that behave differently from traditional stocks and bonds.

Portfolios of oil & gas royalties like Mineral Vault I provide:

Zero correlation to equities

Zero correlation to credit spreads

Direct participation in energy production

Monthly off-chain → on-chain conversions of real cash flow

Geographic and operator diversification across thousands of wells

As global allocators reassess risk frameworks for 2026, real-asset income — especially programmable income — will become a larger share of modern portfolios.

5. 2026 Will Mark the Rise of Tokenized Cash Flow Products

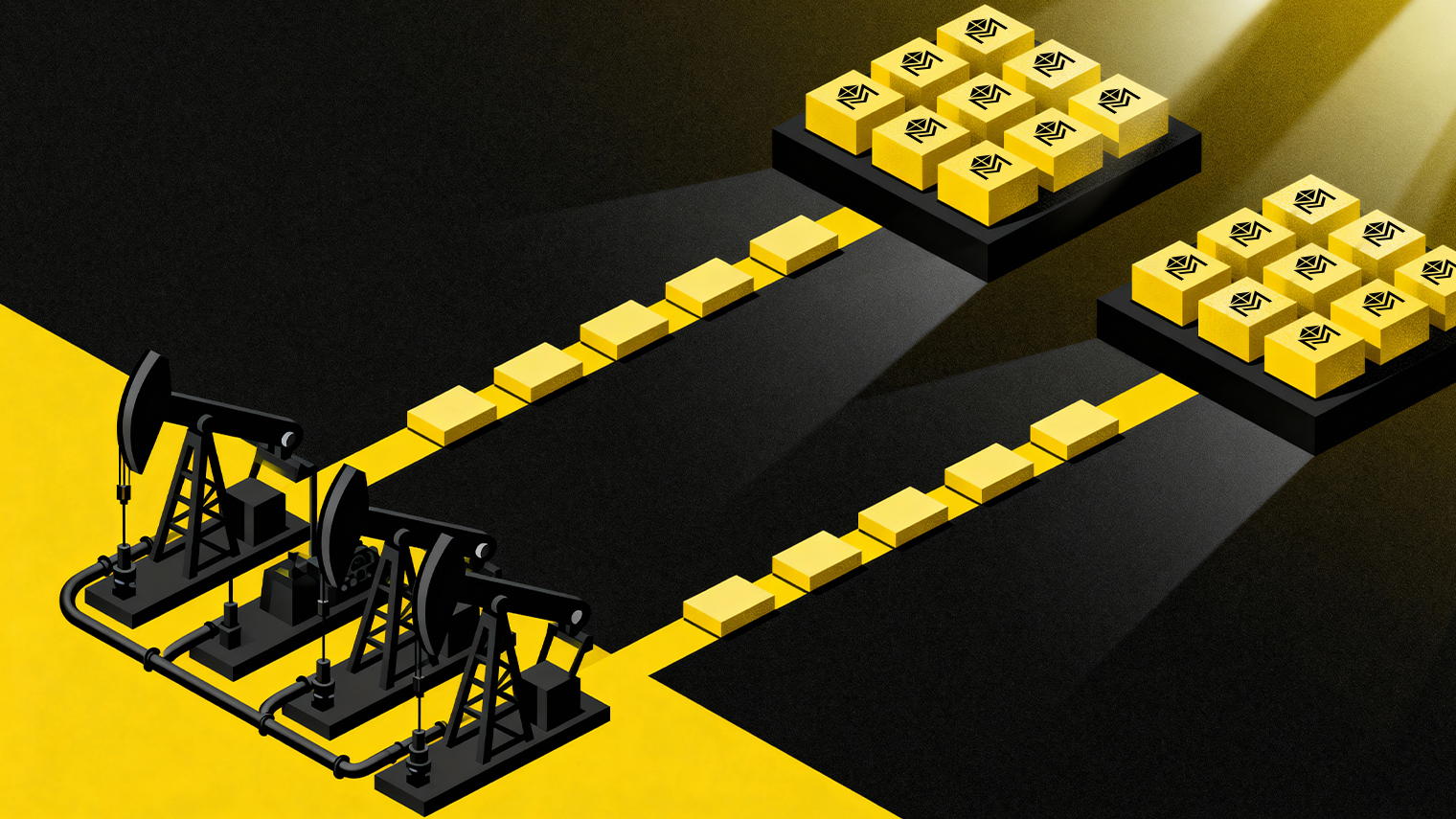

Most RWAs today are tokenized claims or representations of traditional assets. Tokenized royalties are different — they are native cash-flowing assets, generating monthly yield with no intermediary conversion needed.

This positions them for:

Vault integrations

Yield-bearing DeFi primitives

Structured products

Collateralization

Instant composability

In other words, tokenized energy royalties aren’t just assets — they are building blocks for entirely new financial products.

Tokenized real-world yield is the next frontier, and energy royalties are poised to sit at the center of it.

6. Mineral Vault’s Role in the Next Wave

Mineral Vault I validated something powerful:

that private energy assets can be aggregated, de-risked, tokenized, and distributed globally — while generating healthy, transparent monthly income.

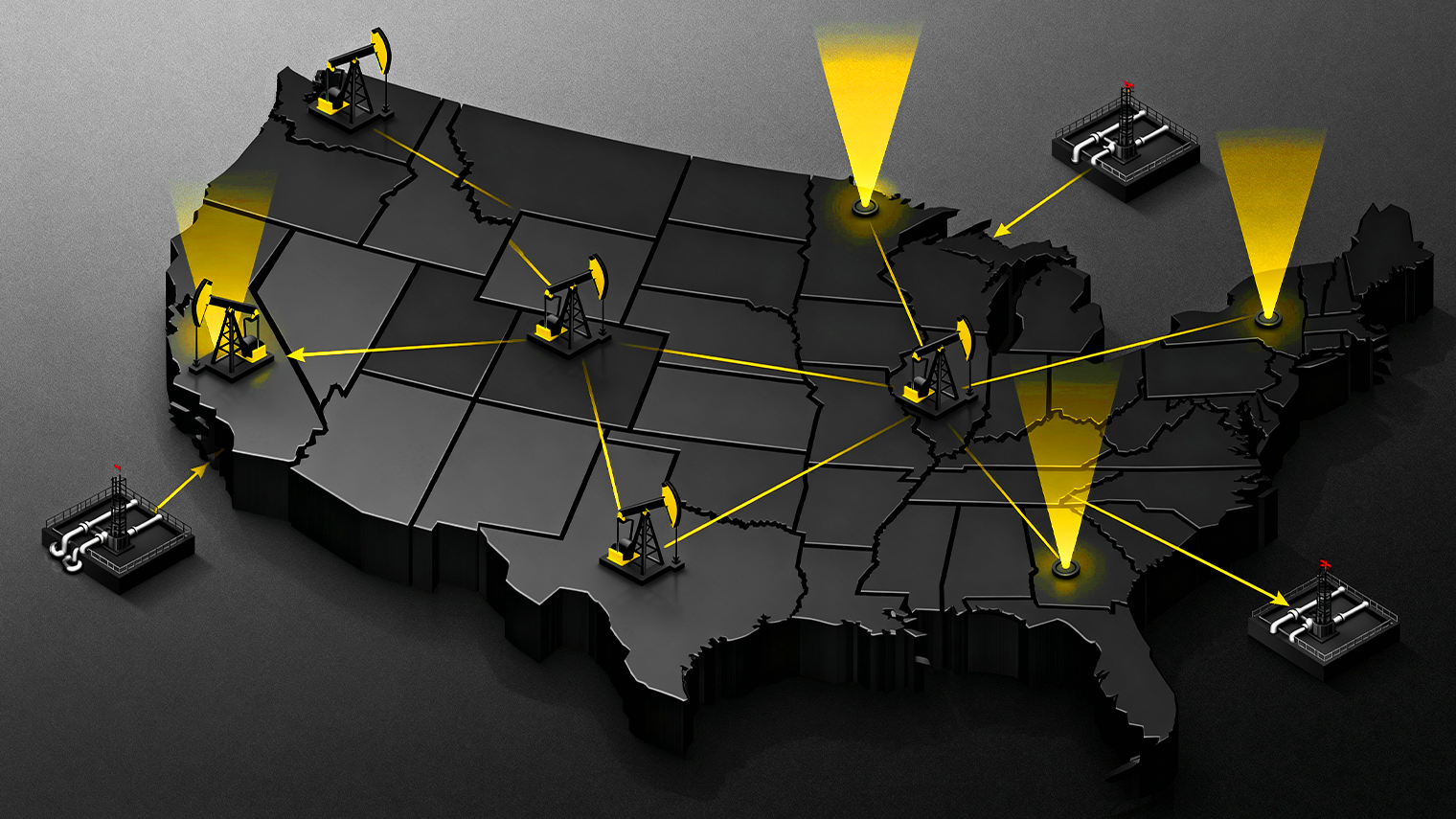

Mineral Vault I spans properties including:

2,500+ producing wells

10,000+ gross acres

150+ operators

9 U.S. states

Diverse commodity exposure (crude oil, natural gas, et al)

Automated USDC yield

…and the model is no longer theoretical. It works — at scale.

As we prepare for Mineral Vault II and additional offerings in 2026 and beyond, our focus is clear:

expand access, deepen diversification, and continue building the world’s premier marketplace for tokenized oil & gas properties.

Closing Thought: A New Financial Era Is Beginning

2024 was the year RWAs gained attention.

2025 was the year infrastructure matured.

2026 will be the year real cash-flowing assets dominate on-chain finance.

Energy royalties — stable, inflation-protected, and operationally passive — are uniquely suited to lead that shift.

By bridging the physical production of American energy with the precision of blockchain finance, Mineral Vault is not just observing the future of investing — We are building it.