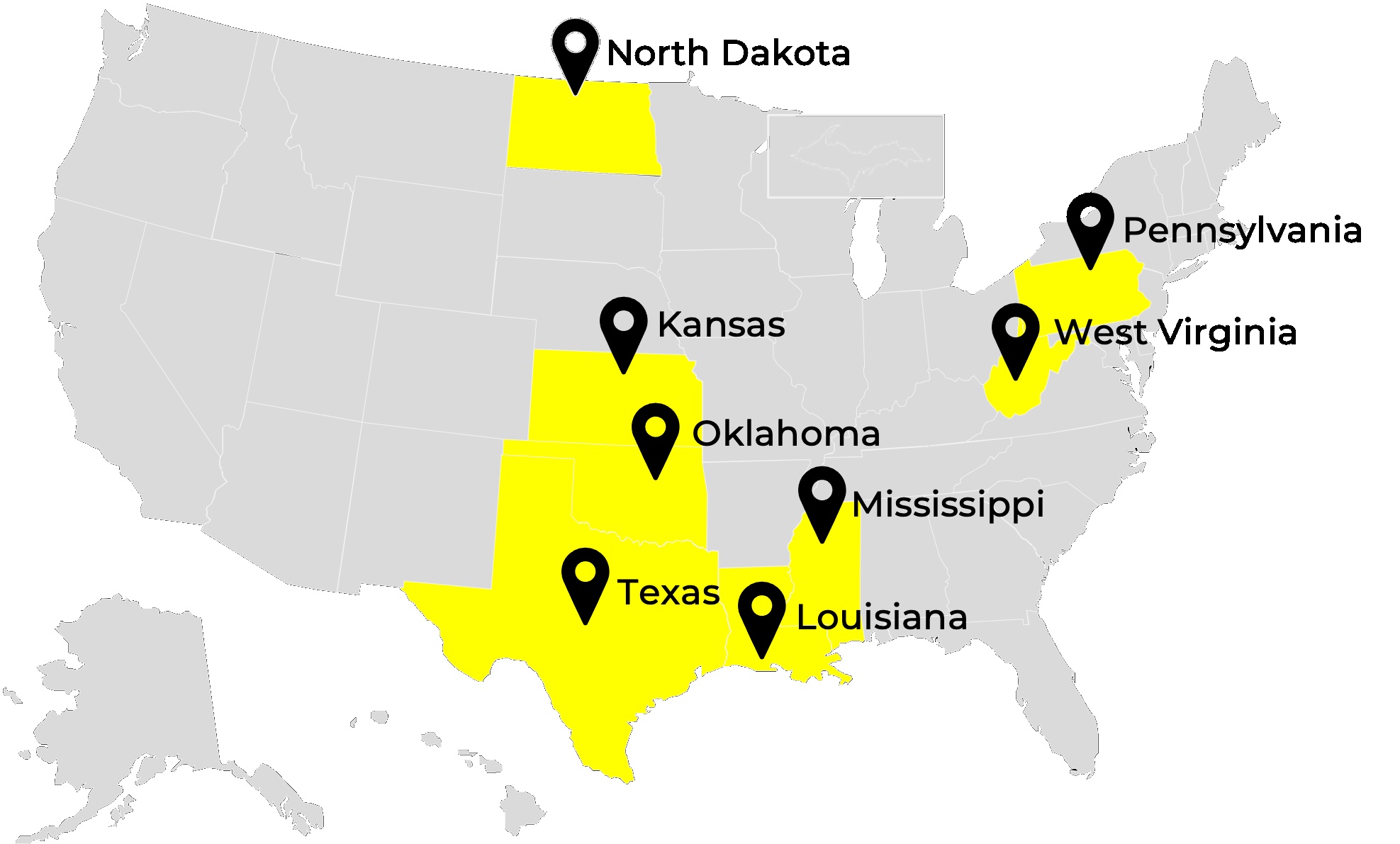

When investors look at Mineral Vault I, what they see is a diversified portfolio of mineral and royalty interests spanning more than 10,000 gross acres and 2,500 producing wells across 9 different U.S. states. What they don’t see, however, is the extensive work that went into creating this portfolio — years of research, negotiation, and due diligence that transformed scattered mineral rights into one of the first tokenized funds of its kind.

Closing 350 Transactions Across 9 States

Every property in Mineral Vault I was acquired between May 2020 and May 2023 by Allegiance Oil & Gas (the oil & gas investment company behind Mineral Vault). This was a period that included volatile oil prices, shifting operator activity, and post-pandemic energy market dynamics. Over those three years, Allegiance completed 350 individual transactions with mineral and royalty owners across the U.S.

These weren’t bulk acquisitions from a single seller, group of sellers, or brokers. Every single counterparty was different! The process required direct negotiation with landowners, estates, and family trusts. In many cases, ownership was fragmented among dozens of heirs, each holding only a fractional interest, and in many transactions curative title was required before the transaction could be finalized.

This painstaking, property-by-property approach created several advantages:

Better pricing control – By avoiding auction environments and brokers, Allegiance could acquire assets at fair market value without paying speculative premiums.

Higher quality assets – With direct relationships, the team could be selective, targeting only properties that met strict evaluation criteria.

Diverse sources – Hundreds of transactions meant exposure to thousands of acres and wells, helping build a portfolio resilient to market swings.

Title resilience – By painstakingly curing title for every property, one at a time, Allegiance was able to close acquisitions with title so clean that they’ve agreed to offer a title guarantee to token holders for all properties in Mineral Vault I – eliminating one of the biggest risks in traditional mineral rights investment.

What Makes a Property Attractive?

Not all mineral interests are created equal. Before becoming part of the Mineral Vault I portfolio, each property was screened using a multi-factor evaluation process designed to balance current production with future upside.

Key criteria included:

Production Track Record – Priority was given to properties with active wells already generating monthly cash flow. This provided immediate yield stability.

Diverse Basin Geography – Holdings were intentionally spread across numerous top U.S. shale plays in completely different geographic areas, including the Permian, Eagle Ford, Bakken, Haynesville, and Barnett, to reduce concentration risk.

Operator Quality – Emphasis was placed on established E&P companies with proven operating track records. And with more than 150 operators represented in the portfolio, operator concentration risk was also greatly mitigated.

Future Development Potential – Properties with additional, undeveloped acreage offered the possibility of new wells, providing natural growth in cash flow and reserve replacement as existing wells deplete.

Commodity Mix – Balancing properties with primarily oil vs. primarily natural gas exposure ensured the portfolio could benefit across numerous, different commodity cycles.

Together, these criteria created a portfolio that wasn’t just cash-flowing today, but also positioned to capture future drilling, leasing, and development opportunities.

Why This Matters for Investors

The value of this disciplined acquisition strategy for investors comes through in three ways: Scale and diversification, stable yield, and upside potential.

The value that scale and diversification hold is that exposure to thousands of wells across multiple states reduces reliance on any single operator, basin or commodity. Stable yield provides value in early dividend reports that confirm steady, monthly royalties from producing properties. Finally, the upside potential value proves vital when new drilling occurs in active basins like the Permian and Eagle Ford, as this unlocks new cash flow streams for investors that partially offset the depletion from existing well production – without requiring new capital from investors.

Importantly, all of this groundwork was done *before* tokenization. Investors entering Mineral Vault I aren’t speculating on future acquisitions. They are stepping into a portfolio that is already diversified, cash-flowing, and de-risked.

From Groundwork to Tokenization

The heavy lifting; from negotiating 350 transactions and verifying title across thousands of wells, to assembling properties across 9 states, was complete before the first token was issued.

By placing this portfolio on-chain, Mineral Vault makes an asset class once limited to insiders available to investors around the world. Investors aren’t just buying exposure to oil and gas properties, they’re accessing an asset backed by years of acquisition expertise, made liquid through blockchain infrastructure. Tokens bring efficiency, transparency, and liquidity to an industry that historically required significant capital and private connections.

Behind every digital token is a real, tangible asset. In the case of Mineral Vault I, those assets were carefully sourced, one deal at a time, by a team with decades of oil and gas experience.

That’s what makes Mineral Vault different:

A portfolio built on solid ground.

Engineered for yield today and upside tomorrow.

Made accessible to investors everywhere through tokenization.

Inside Mineral Vault I: What Our First Dividend Reports Tell Us

Inside Mineral Vault I: What Our First Dividend Reports Tell Us  Why Tokenize Mineral Interests?

Why Tokenize Mineral Interests?  Mineral Interests: An Overview

Mineral Interests: An Overview